USDJPY Breaking Out Ahead of CPI

Yen Hits 1.5 Year Lows

USDJPY has broken out to its highest levels since H1 2024 today as USD strength and JPY weakness continue to develop as key FX themes in January. USD has been on a steady grind higher this month, expect for some downside action yesterday in response to news that the US government is investigating Fed chairman Jerome Powell over alleged excessive spending on Fed renovation costs last year. More broadly, USD has risen this month as a result of weakened Fed easing expectations. On the back of a fresh fall in the unemployment rate (and a rise in wages), traders now see a less than 5% chance of a cut this month and a less than 30% chance of a cut in March.

US CPI On Watch

Looking ahead today, focus will be on the latest US inflation data. Wall Street is looking for annualised CPI to remain unchanged at 2.7% for December with a small rise in monthly core CPI. If seen, this data should keep near-term easing prospects muted, keeping USD supported. Any upside surprise would clearly have a stronger upward impact on the pair while a downside surprise might revive March easing expectations causing some unwinding of late USDJPY longs.

BOJ Expectations

JPY has weakened recently amidst chatter that the BOJ will likely hold off from a follow-up rate-hike this month, disappointing JPY bulls. Additionally, news this week that the country might face a snap election is causing furtehr uncertainty among investors, leading to JPY outflows as trader await concrete news. If an election is called, this could lead to further JPY losses near-term.

Technical Views

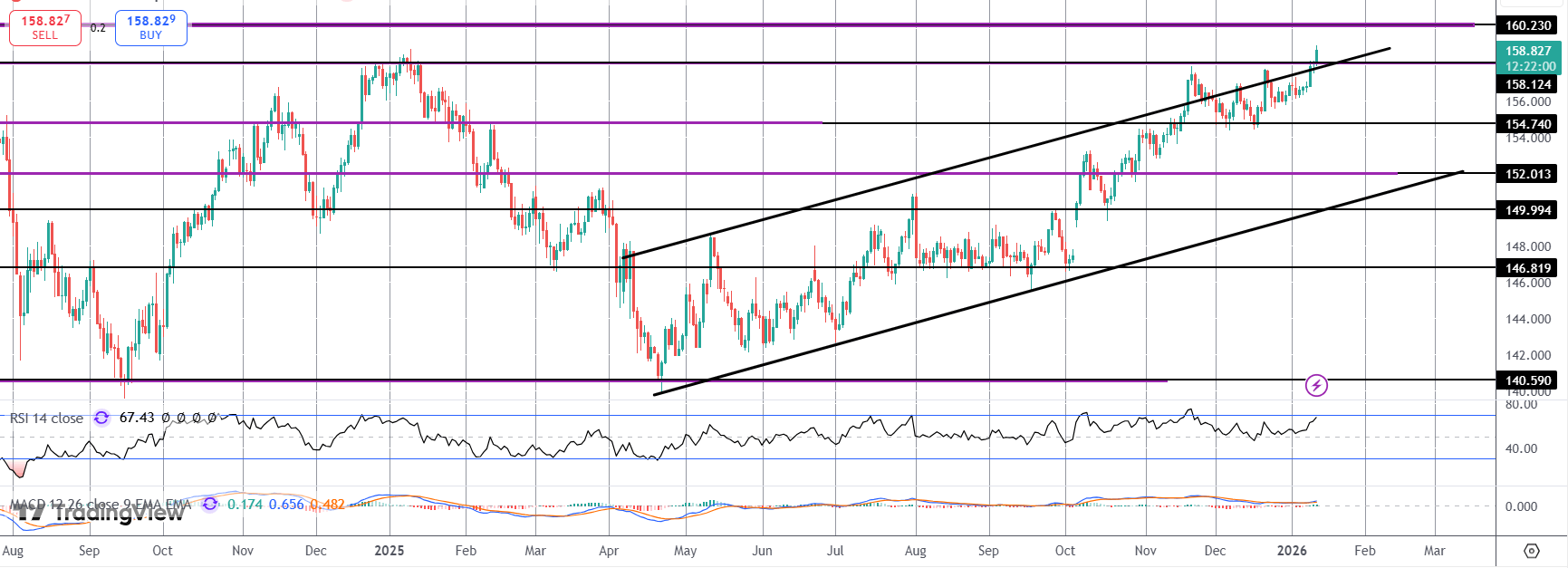

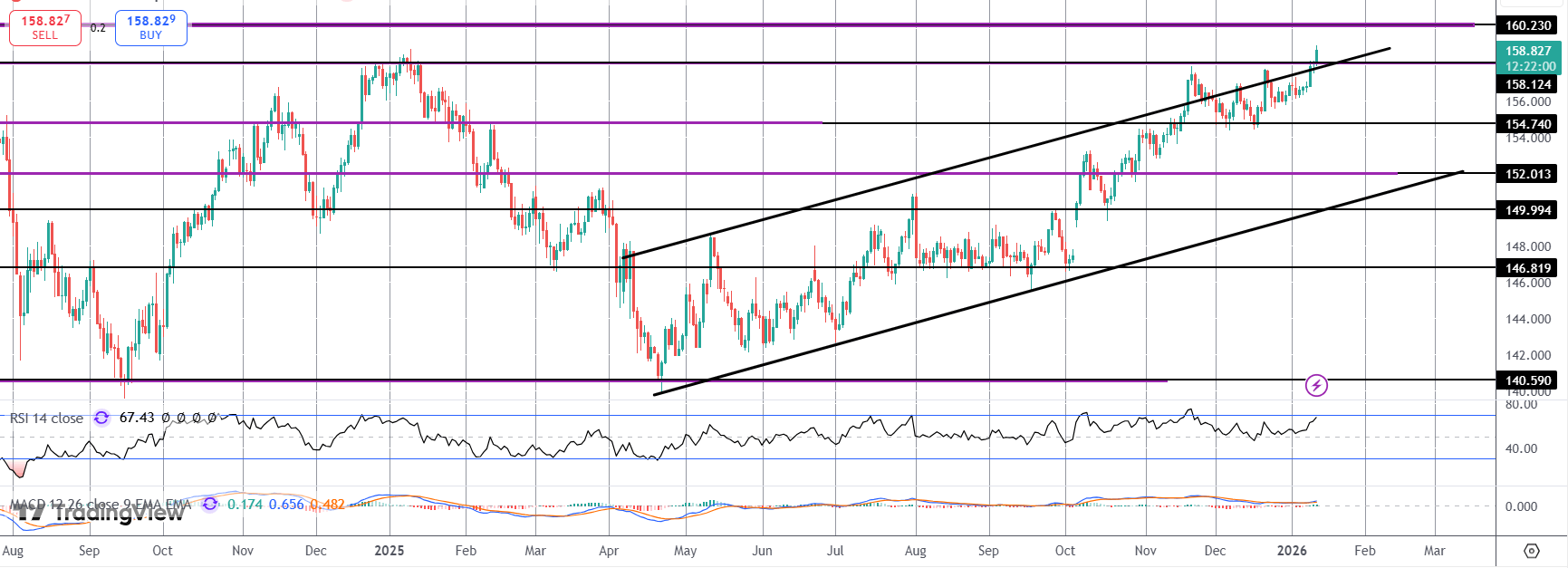

USDJPY

The rally in USDJPY has seen the pair breaking out above the bull channel highs and the 158.12 level. With momentum studies bullish, focus is now on a test of the 160.23 level next. Should we see any correction back below 158.12, 154.74 will be the next support to monitor.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.