USDJPY Testing 155 - Intervention Risks Growing

Rally Continues

USDJPY continues to push higher here with the pair hitting 9-month highs today, closing in on a test of the YTD highs now just around 100-pips above. The move comes despite continued verbal intervention from Japanese officials recently and is seen despite a pullback in USD over the last week. Indeed, the move appears more driven by JPY weakness than USD strength here.

US Data Due

Weak private sector jobs data has revived concern about the US labour market and the prospect of further Fed easing next month. With the US govt shutdown expected to come to an end this week. We should see an influx of US data in coming weeks with traders paying close attention to delayed NFP and CPI releases. Any fresh downside in those readings should see December rate cut pricing surging higher, putting renewed pressure on USD near-term.

Risk-On Hurting Yen

On the JPY side, the surge in risk appetite over recent months has hampered the currency greatly. With global stock markets seen charging higher across the board, safe-haven demand has evaporated. This dynamic has coincided with the recent political shift in Japan under new PM Takaichi who is expected to take a more fiscally expansive approach, accompanied by a more dovish stance from the BOJ. Together, these factor shave seen JPY plunging lower in recent months.

Verbal Intervention & BOJ Expectations

Japanese officials continue to jawbone with finance minister Katayama signalling concern over the negative impact of a weaker JPY on the domestic economy. Katayama has spoken out on currency moves several times over the last two months with little impact so far. The view is of course that intervention risks are growing if USDJPY crosses above 155 though it might take a BOJ rate hike to properly cap the rally.

Technical Views

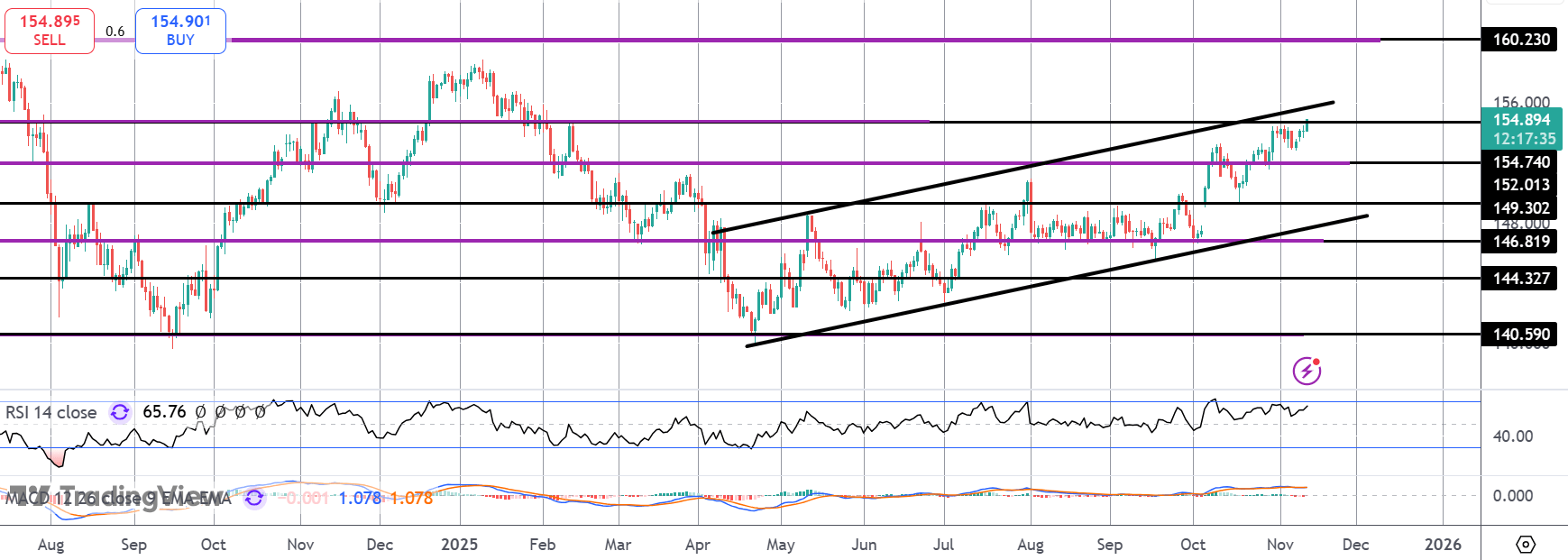

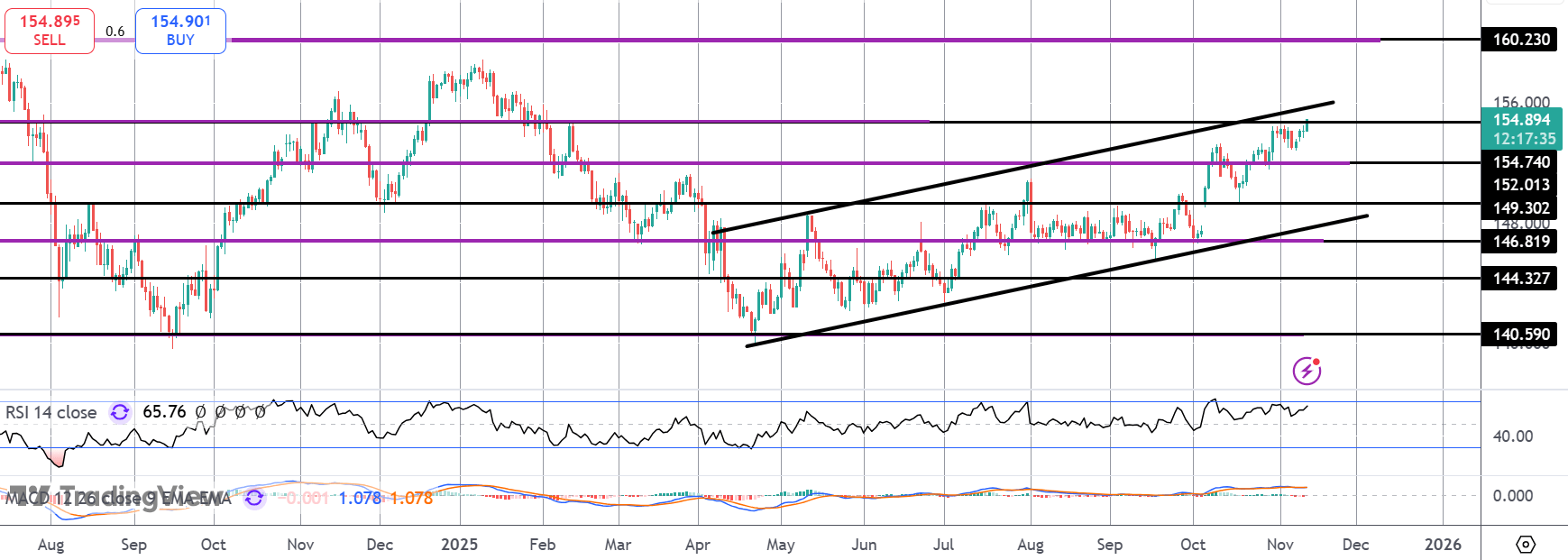

USDJPY

The rally in USDJPY is seeing price testing above the 154.74 level here with the bull channel highs just above. If price breaks higher here, focus turns to 160.23 as the next target to note. If we reverse lower, 149.30 will be the key support to watch, with the channel lows coming in around there also.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.