SP500 LDN TRADING UPDATE 16/1/26

SP500 LDN TRADING UPDATE 16/1/26

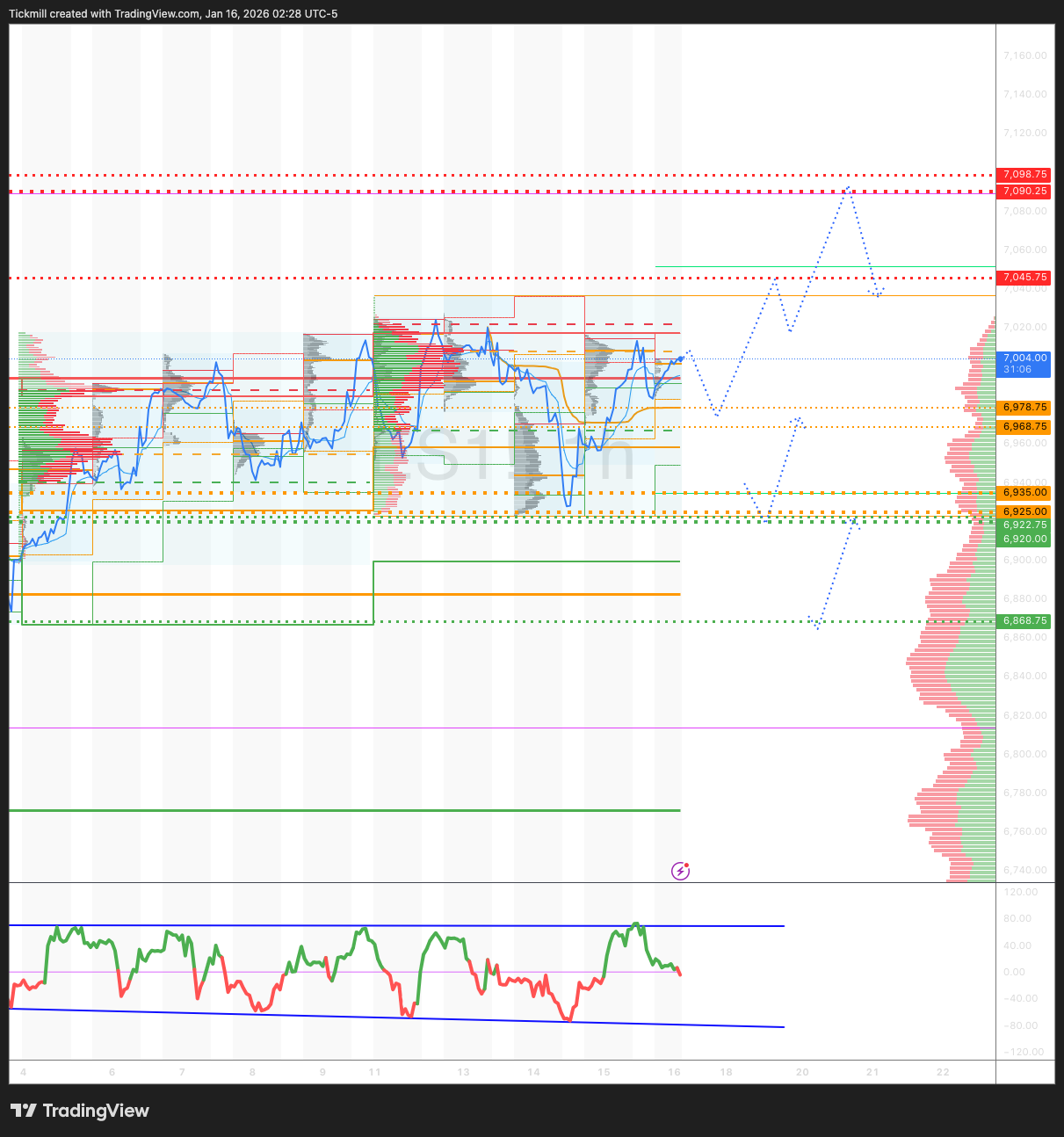

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6925/35

WEEKLY RANGE RES 7090 SUP 6920

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

WEEKLY VWAP BULLISH 6938

MONTHLY VWAP BULLISH 6854

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6932

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

The SPX aggregate gamma flip zone is around the 6880 level. There is a sharp increase in upside gamma starting at 6970 and above. Conversely, below 6770, the downside gamma becomes very steep.

DAILY STRUCTURE – BALANCE - 7024/6923

DAILY VWAP BULLISH - 6988

DAILY BULL BEAR ZONE 6978/68

DAILY RANGE RES 7021 SUP 6921

2 SIGMA RES 7098 SUP 6868

VIX BULL BEAR ZONE 17.7

PUT/CALL RATIO 1.27

TRADES & TARGETS

LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON REJECT/RECLAIM WEEKLY RANGE SUP TARGET DAILY BULL BEAR ZONE

SHORT ON REJECT RECLAIM OF WEEKLY RANGE RES TRGET 7035

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “DEFENSIVE TILT”

US Equities

Key Focus:

The market is moving higher, led by Tech gains following TSM’s exceptionally strong results overnight. This has boosted the broader AI/Semiconductor trade, with our CapEx Beneficiaries basket (GSXUCAPX, +3.1%) experiencing its best day since May. The broadening trade remains evident, with RTY outperforming NDX and SPX, following the widest spread between RSP and SPX observed yesterday since late November.

- Semiconductors Demand: Strong demand for semis continues, with notable buying interest in NVDA, AVGO, WDC, and INTC, driven by TSM’s positive datapoint. There’s ongoing generalist interest in Memory (a consistent theme this year). Semicap stocks are holding gains early in the session, though questions remain about their ability to sustain these levels given the year-to-date rally.

- Banking Sector: Bank weakness is reversing after two challenging days. Companies reporting today are up 4-6%, with XLF poised to break a four-day losing streak. This contrasts with prior sentiment that had been summarized as “modestly constructive for the ’26 fundamental outlook.”

- Healthcare Developments: The White House released a Fact Sheet on “The Great Healthcare Plan.” Key proposals include:

1. Expanding MFN pricing scope.

2. Increasing OTC availability.

3. Redirecting enhanced subsidies on exchanges directly to consumers (no mention of HSAs).

4. Announcing a cost-sharing reduction program.

5. Ending PBM rebates.

6. Increasing transparency/disclosure from insurance companies and healthcare providers, particularly regarding MLRs, pricing, denials, wait times, etc.

CEOs from UNH, CVS, CI, and ELV are expected to testify in House E&C and W&M committee hearings next Thursday (1/22).

Our Franchise:

- Overall activity levels are up 11% compared to the trailing two weeks, with market volumes up 21% versus the 10-day moving average.

- Our floor tilts 2% better to buy, with both Long-Only (LOs) and Hedge Funds (HFs) active on the bid.

- LOs are 10% better to buy, adding exposure in Communication Services, Energy, and Consumer Discretionary, while reducing positions in Healthcare and Financials.

- HFs are 6% better to buy, ranking in the 88th percentile over the last year. Demand is concentrated in Tech, Healthcare, and Communication Services, with the most notable supply in Macro Products.

ETF activity represents ~32% of tape volume to start the year, nearly 4 percentage points above the average run rate over the last eight years. Yesterday, the spread between ETFs and Top of Book liquidity widened significantly during lunchtime, and this trend continues today despite a broadly stronger tape. A wider spread between these two data points indicates a more challenging trading environment.

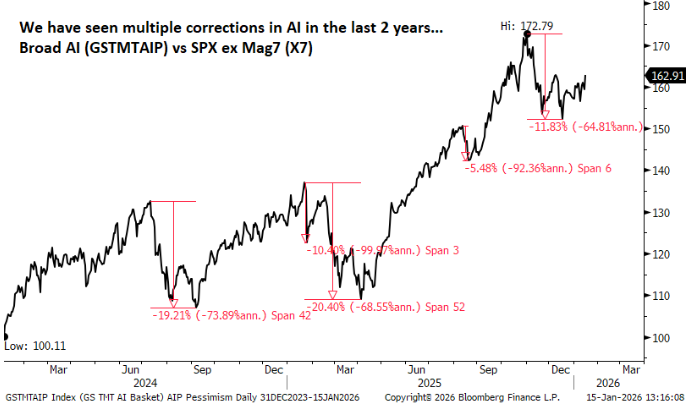

The desk is addressing questions about shifting investments from AI to other equity market segments. Key concerns include: (1) significant investments in data center infrastructure with uncertain returns, sometimes funded by debt, (2) potential mismeasurement of data center demand and risks of oversupply, and (3) midterm elections possibly introducing regulatory controls on data center locations and utility costs.

Despite these concerns, the desk does not anticipate a major sell-off in the AI sector by 2026. AI valuations appear reasonable, and Mag5 companies (excluding Google) have underperformed despite healthy earnings growth. The desk remains bullish on AI infrastructure given growing hardware and power demand, though midterm elections may bring focus to this area.

The preferred approach to diversification is identifying non-tech companies effectively integrating AI to improve productivity. The AI Productivity basket (GSXUPROD) includes banks, insurers, retailers, logistics, healthcare, and restaurants leveraging AI for cost reduction and margin improvement.

Recommended trades:

1. Long non-tech/non-AI companies leveraging AI (GSXUPROD).

2. Long Mag5 excluding Google (GSCBM5XG).

3. Long AI Volatility (GSVIAIV1) to hedge risks tied to AI politicization ahead of elections.

Recent corrections in the AI ecosystem have seen the Broad AI basket (GSTMTAIP) underperform the SPX Index excluding the Mag7 (X7) by ~12pp. While recovery is ongoing, this correction is not the most severe in the past two years.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!